Swiss Watch Industry Export Statistics - August 2020

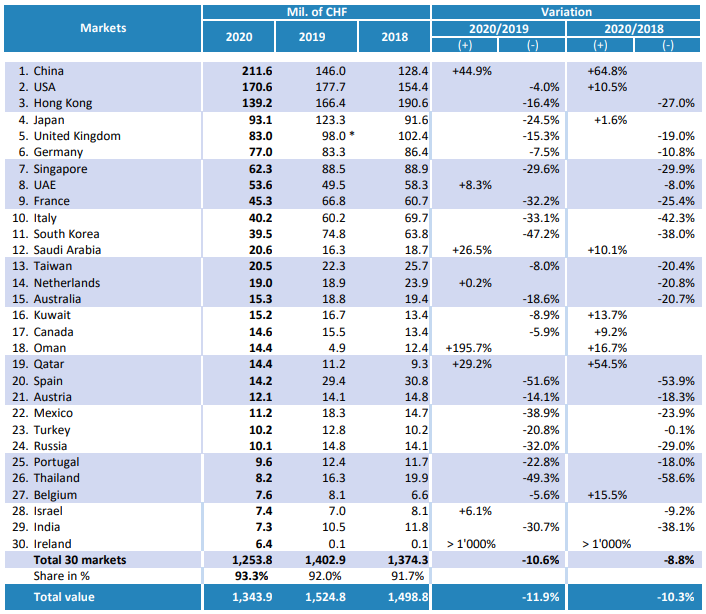

As the Swiss watch industry continues to crawl out of the funk of 2020, Swiss watch exports saw a slowing in their declines. August exports totaled CHF 1.3 billion, a decline of 11.9% year over year which was close to our prediction of around 15%.

We noticed a plateau forming for the 12 month moving average last month, and as we predicted, the plateau continued to level off just above the -20% mark. This is obviously a significant contraction in exports, but hopefully this will slowly turn itself around.

Most metal types saw double digit declines compared to a year ago, besides precious metals which only saw a change of -8.5%, which could indicate a safe haven that investors and collectors want to rush to. If you look at watches by price category, the more expensive watches are almost returning to normal export numbers, with almost the same amount of units exported as last year. But, for the month, units still saw sharp declines in units and in value coming in at -31% and -11% respectively.

Our top 6 markets remained fairly similar to the rest of the year, comprised of many Asian markets, the United States and United Kingdom. It was nice to see positive variation from this time last year in more than a couple markets. Of course we had the largest increases in Oman (+195%) and Ireland taking the top variation this month of over 1,000%!

September Predictions

September was a fairly steady month for global economies, as they all started the long dig out of the recessionary environment we find ourselves in. Continuing on the slow recovery, we believe watch exports will still be in the red for year over year performance, but the decline will still come down. We predict a -10% result for swiss watch exports, which will hopefully lead to good things in the coming months. Unfortunately, going into the winter months means sickness may become more prevalent, but we will have to see how things turn out.

Enjoy!