The End of the Good Results? Swiss Watch Industry Export Statistics - March 2022

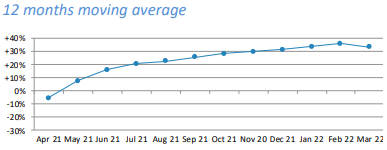

Watch exports continued to show positive signs compared to this time last year. Exports totaled just over CHF 2 billion, about CHF 200 million more than this time last year. March 2021 was the first comparison to pandemic export results, and so it is no surprise that the 12 month moving average has moved negatively for the first time in 12 months.

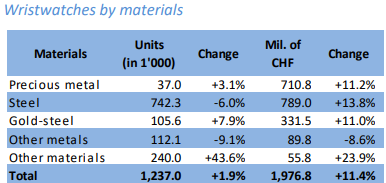

Precious metal and steel watches were the driving forces of exports in March 2022 with over CHF 700 million total for the month. Interestingly, steel watches sold fewer units compared to this time last year, but value was up by 13.8%. Gold-steel wristwatches were in the third position. Watches over CHF 3,000 saw the largest year over year growth in units and value. The other price categories remained relatively unchanged besides CHF 200-500, which saw sharp declines in both units and value.

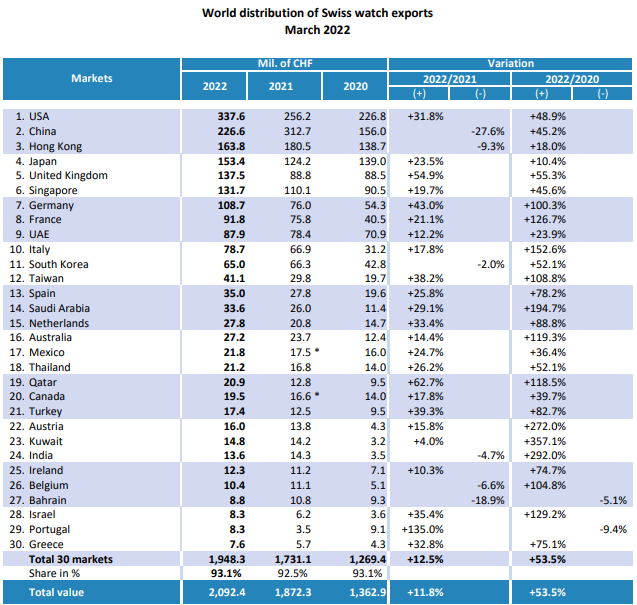

The top six markets, which made up 55% of the market volume for March, were topped by USA, China and Hong Kong. While USA saw positive growth compared to 2021, China and Hong Kong saw declines, mainly driven by very successful export numbers from a year prior. But, most other markets saw double digit growth compared to 2021. Portugal saw a growth of over 135%, topping the markets with the largest growth rate.

April Predictions

While the year started off on a very successful note, inflation and economic policy has shown an ability to have a large impact on the growth potential of many financial assets. While watches are a discretionary income purchase, we may see a slowing of export results in Q2. It can be expected that export results will hover around the CHF 2 billion mark for the next few months.

Enjoy!