Watch Business: How Can We Learn from the Trouble in the Watch Industry?

Every watch enthusiast is currently tracking the watch industry growth. After a lackluster few years, the industry is finally showing that the recovery is in full swing. With the increase in watch exports, naturally sales would follow. The disposable income that consumers have to spend would generally follow the cycle of economic growth. So, one could compare the economic growth with watch exports and find a pattern that somewhat resembles both upwards and downwards trends for both industries. This trend can be seen by overlaying swiss export data with economic growth data. For economic growth data, GDP growth by year was used below:

Looking at the graph, one can identify that the export curve is not as smooth as the GDP curve. This difference is in part because GDP is a much larger number, and changes in exports has a much larger effect. Also, it is in part due to the collection of data which has been done on a yearly basis. Export numbers will change a lot more frequently that the percentage change of GDP which is much more tightly controlled.

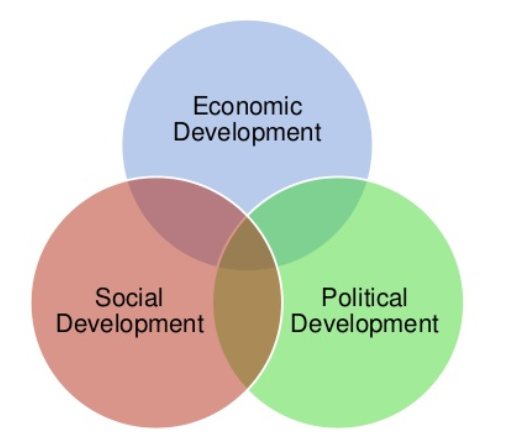

Naturally, we see a large decrease in exports from 2008 to 2009 due to the economic crisis, but the reaction post crisis is what is interesting. In 2010, there is a huge recovery in exports. There is a recovery in GDP which, through our argument made above, suggest the increase in exports to be normal. But then in 2011, GDP did not grow as rapidly, while exports increased even more than the previous year. This behaviour would suggest a disconnect between economic growth rate and importer decision making. The decisions to continue to import Swiss watches by retailers was motivated by external factors other than economic trends. Possible factors that could be motivation behind the decision could be watch market related or non-watch market related. A graphic below shows how we found further areas of which the possible disconnect could be related to:

In subsequent blog posts, these other factors will be explored.

To return to the comparison of GDP growth to Swiss watch exports, from 2011 to 2013, export percentages decreased. The outlook on the US watch market was probably still positive, but they noticed it was not meeting what was expected in 2010. This percentage growth change would represent a plateauing export curve that is followed by a slight increase in 2014 with a negative export curve that followed for three years.

Many people have publicly stated that inventory levels for many retailers are too high, which is why exports of Swiss watches have decreased. Richard Mille, head of his own independent watch company, stated that “some brands bought back unsold watches, but the problem has not been solved” (Koltrowitz 2018). He attributed it to the fact that “some people in the watch industry just don’t learn the lessons of the past. As soon as demand picks up, they flood the market”. Our subsequent blog post where we explore the relationship between supply and demand will expand on this concept.

Laurent Dordet, who heads Hermes’ watch business, said that “many of [their] competitors still have overcapacity and produce too many watches that jam the retail network” (Koltrowitz 2018). This would identify the producer as where the trouble lies, and by extension the leadership of the brands. Normally, business judgments are based on economic data. There must be a disconnect between economic data, both market and national/international economic data, and the leadership of multiple watch brands. Again, this will be explored in a subsequent blog post.

The watch industry has seen a recovery, but what needs to be done is for the industry to learn from its mistakes from the past. The point of this blog post series is to identify those mistakes and identify ways to mitigate the risk. We also hope to identify possible trends to identify that can be useful in the future. These techniques could be used to forecast export figures, but also could be applied to how to track watch company stocks fluctuate as well.

Sources:

https://www.bloomberg.com/news/articles/2017-09-28/is-the-swiss-watch-export-slump-over

https://tradingeconomics.com/united-states/gdp-growth

https://www.reuters.com/article/us-swiss-watches/stock-levels-at-watch-retailers-still-too-high-executives-say-idUSKBN1F520Z

Photo Source:

https://robbreport.com/style/watch-collector/going-bespoke-haute-horlogerie-masters-deliver-customized-watches-eg17-2751391/