Watch Business: How Can We Learn From the Trouble in the Watch Industry? Part Two

"Non-Watch-Market" Related Factors

The watch industry has seen a recovery over the last year in its Swiss watch exports. Previously, the industry had seen a sharp decline in exports since 2011. This trend ran counter to the economic growth of world economy which points to a disconnect in economic growth and decision making by Swiss watch companies.

We will analyze this disconnect in Part 1 of our short series which can be found HERE

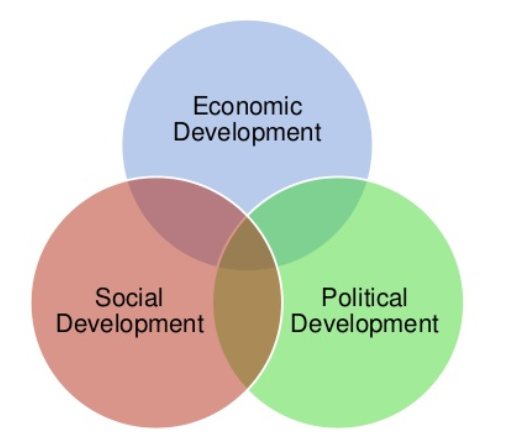

One of our major conclusions from Part 1 was that in 2011, the disconnect started. We created a graphic that divided the possible factors that led to this disconnect. The graphic is below:

We will focus on the non-watch-market related factors in this blog post.

To focus the analysis, we will use the USA and Switzerland as our two countries for our conclusions.

Political

Political decisions that are made outside of the watch market can have larger implications on the exportation of watches from Switzerland to the USA. One political decision that could have been made was adjusting the import and export rules for watches and clocks by US Customs and Border Protection (CBP). The CBP has An Informed Compliance Publication that assists in detailing how watches and clocks are to be marked and imported. This publication was released in 2000. Most of the laws are from "December 8, 1993, Title VI of the North American Free Trade Agreement Implementation Act (Pub. L. 103-182, 107 Stat. 2057), also known as the Customs Modernization or “Mod” Act" (CBP 2015). The document was put together to insure those in the trading community would understand how the decisions were to be implemented.

The document states that it is reviewed yearly, but shows that no changes have been made since June 2005 (see image to the right). We can conclude that no changes to the import and export laws affected the flow of watches into the USA in 2011.

From researching Swiss laws pertaining to the export of watches and clocks, no changes seem to have been made due the large portion of GDP that comes from exports for the country. Political reasons can therefore be rule out as a major factor that contributed to the 2011 decision making disconnect.

Social

Analyzing social trends can be an extremely broad task to undertake. The range of concepts that could be discussed are endless and can be interpreted in multiple ways due to a wide range of perspectives. Arguably the largest social trend, however, that does not have to do with the watch market is globalization. Globalization has allowed for economies to flourish by working with one another, but also allowed for more travel. In fact, total revenue for Swiss tourism in 2016 was CHF 44.8 billion (STF 2017).

Adding to the huge tourism revenue, a large portion of the individuals who travelled to Switzerland went to areas where watchmaking is a large part of their economy such as Valais, Geneva and Ticino (STF 2017). The graph below shows the supply and demand for the hotel industry and if you look at Geneva data, almost 400% more of the overnight stays were foreigners than Swiss citizens.

With tourism expanding, so too does exposure to the watch industry. And one can not forget the explosion of watches on social networks like Instagram. This "Watch World Social Media Movement" gave even more people exposure to watches, creating higher demand for the industry.

From this, one would conclude that the Watch World Social Media Movement created demand, and should therefore drive exports from Switzerland up. As we know, this was not the case and exports went down. One could attribute that the second hand market and vintage markets hitting consumers may have been a factor. They can buy watches for much less but still be a part of the watch movement. These factors, however, are more "watch market" related factors, and will be discussed in our supply analysis blog post.

Economic

The last "non-watch-market" related factor has to do with the economic positions of the USA and Switzerland. Switzerland has seen consistent GDP growth over the last eight years, growing at growth of "1.5 per cent [in 2017]" (KOF Bulletin 2017).

Switzerland has always been known as a powerhouse and robust economy that is often used as a model for consistency. Economically, it has grown ever since 2011, meaning that a decline in exports of watches does not match the growth trajectory.

As discussed in our last blog post, the USA economy has seen positive GDP growth over the last eight years, which also does not match the decline in exportation of Swiss watches.

Conclusions

Political: No large political changes have been implemented by the US or Swiss government to explain the declining export figures of Swiss watches.

Social: An increase in globalization, tourism and therefore Swiss watch brand awareness through social media movements can be attributed to an increase in demand for Swiss watches. This factor runs counter to the decline in Swiss watch exports.

Economic: Both the USA and Swiss economies have seen positive GDP growth since 2011, running counter to the declining export figures.

Sources:

https://www.cbp.gov/sites/default/files/assets/documents/2016-Apr/icp055_3.pdf

https://www.stv-fst.ch/sites/default/files/2017-10/StiZ_en.pdf

https://www.kof.ethz.ch/en/news-and-events/news/kof-bulletin/kof-bulletin/2017/04/further-recovery-of-the-swiss-economy.html

Photo Source:

https://apessay.com/order/?rid=cc49f4f3231bb03f